Company formation in Germany with all the necessary registrations you need

You Want To Set Up A Company In Germany

But Do Not Know Ho To Start?

To start a German company as a foreigner can be turn into difficulty, because of the German bureaucracy, banks which are not willing to open an account and numerous regulations that must be complied with.

Over the past years, we have guided over thousand of entrepreneurs from over 50 countries and 6 continents in establishing and running a successful German company.

- We…

- Coordinate your company registration from A to Z (you do not have to travel to Germany)

- Support you in opening a business bank account

- Support your application for EORI number (required for import/export activity)

- Coordinate the application for your tax number and VAT number through a German tax advisor

- And we stay by your side even after foundation.

We will be your personal success manager for the entire process, and glad to assist you at any time.

Company Formation from A to Z

Setting up a company in Germany is complex, but with our local support it becomes simple and legally secure. All you have to do is sign anywhere in the world and we’ll do the rest for you.

Premium All-In-One Services for your German company

In 4 Steps To Your Company In Germany

Preparation and Notary Appointment

With us, the preparation of your company registration in Germany usually takes less than 1 working day. However, the scheduling of a notary appointment can be delayed, depending on the availability of notaries and the city you would like to sign.

It is up to you whether you decide to be present at the notarisation or whether you prefer to sign the documents abroad. The decision has no influence on our fee.

Bank Account Opening

After the notary appointment, you must open a new business account for your GmbH or UG in formation. We support you competently and quickly in opening an account with our partner banks.

Commercial and Business Registration

After paying in the share capital, there is a period of waiting for the entry in the commercial register. During this time you are not yet allowed to start any business activity with the company. If you would rather get started immediately after the notary appointment, you can also purchase a shelf company.

Application for Tax, VAT & EORI numbers

Once all registrations have been made, it is possibly to apply for your company’s tax number, EU VAT number and EORI number.

* The times are based on experience, which varies from city to city and from foundation to foundation. We recommend that you calculate about 1-3 months for the entire process.

Need a faster solution? Check our imadietely available shelf companies here.

Do you already know what kind of company you would like to register in Germany?

GmbH formation

The establishment of a German GmbH company requires a minimum share capital of 25,000 EUR, of which at least half, that is, 12,500 EUR, must be paid into the company’s bank account after the business is set up.

A German GmbH (limited liability company) is an internationally recognised and renowned business form that demonstrates confidence to its business partners.

UG formation

Establishing a UG company (or Mini-GmbH) can be a good alternative to setting up a GmbH if the owners avail of less than 12,500 EUR, or if they would like to try out their idea with less financial risk at first.

A UG is also a limited liability company type. Its biggest benefit is the lower share capital of 1 EUR symbolic.

Not sure?

If you are not sure regarding the company form, try our free company type configurator with which you can find the ideal legal type for your business in Germany.

GmbH-UG.com Is The Right

Choice For You If…

- You want to establish a company in Germany and to have success with them

- You do not want to take care about paper work and burocracy

- You are looking for an around solution, which includes everything you will need to start your company in Germany

- You would like to have a consulting company with headquarters and network in Germany at your side

- You want a package price, without hidden fees

- You are looking for a strong partner who still holds the old “German values”, such as punctuality and fairness

+1 point for GmbH-UG.com: we donate 1% of our profits to charity every year.

Choose Your Formation Package And Start Online

| UG | GmbH | |

|---|---|---|

| Preparation: we check your chosen company name with the local Chamber of Commerce (IHK) and formulate your company purpose from the desired activities |

|

|

| Notarisation: All shareholders and managing directors can sign anywhere in the world - even at different locations. We prepare and arrange the notary appointment for you |

|

|

| Bilingual Certificate of Incorporation (German and English) |

|

|

| Support with opening a business bank account |

|

|

| We will notify you as soon as the entry in the commercial register has been made and you will receive a copy of the extract from the commercial register |

|

|

| Entry in the transparency register and business registration (Gewerbeanmeldung) |

|

|

| Application for tax number and VAT number (via German tax advisor) |

|

|

| Application for EORI number (optional, for free) |

|

|

| Personal Client Success Manager, who you can reach by phone or e-mail at any time from Mon to Fri |

|

|

| You can use your desired company address or choose a virtual office in one of our 13 locations |

|

|

|

from 1,800 EUR

+19% VAT |

from 2,200 EUR

+19% VAT |

Frequently Asked Questions

In Germany, the companies with capital, – such as the GmbH and the UG – are obliged to pay corporate tax (in German: Körperschaftssteuer) and local business tax (in German: Gewerbesteuer). Both tax types are to be paid after the annual profit. The corporate income tax rate including ‘Solidaritätszuschlag’ at present is 15.825%, while the local business tax varies from town to town, it is usually between 7-18%. You can easily estimate your paible taxes with our free tax calculator tool.

The duration of the company registration depends on several factors, but it can be stated in general that the registration of a newly founded company and to receive its tax numbers takes a total of 1-3 months. If one needs an immediate solution, then the process can be shortened with the purchase of an entire company, so-called Vorratsgesellschaft or shelf company / ready-made company. These are such companies having performed no active business which have tax number and bank account number. The objective of their foundation is solely their later resale.

No, it is not necessary. The company formation in Germany can be done with our office without traveling. All shareholders and managing directors can therefore sign the required documents anywhere in the world.

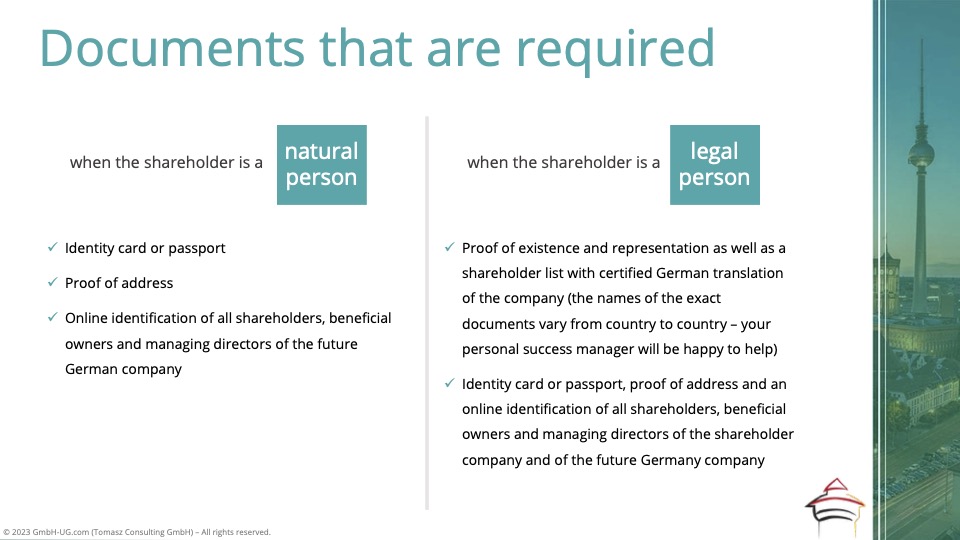

If the owners of the company to be established are natural persons, then all you need is your valid personal ID or passport. If the owner of the German company will be another company, then its articles of association and an up-to-date copy of the register is required from that company in official German translation and with Apostille endorsement.

After ordering, we will send you an exact list with the required documents. It is not worth getting the documents in advance, because many of the certificates are only valid for a limited period of time.

To start your company formation in Germany, please choose a formation package here.

Regardless of whether your German company performs active business or not, you are to fulfil certain obligations. You can learn more about this and the occurring permanent costs in our following blog article: The costs of maintaining a company in Germany in 2025.

If required, we will be glad to help you change, sell or dissolve the company. Please do not hesitate to contact us!