We had to urgently open our new business in Germany. The whole process was quite daunting but Kristof from GmbH-UG.com was extremely helpful from the first moment I contacted him. Quick to respond, precise and detailed with his instructions. The whole process was made very quick and easy for us. Highly recommended!

To start a German company as a foreigner can be turn into dificculty, because of the German burocracy, banks which are not willing to open an account and numerous regulations that must be complied with.

Over the past years, we have guided hundreds of entrepreneurs every year from over 40 countries and 6 continents in establishing and running a successfull German company.

We will be your personal success manager for the entire process, and happy to assist you at any time.

With us, the preparation of your company registration in Germany usually takes less than 24 hours. However, the scheduling of a notary appointment can be delayed, depending on the availability of notaries and the city you would like to sign. Thanks to our network of notaries German-wide, we usually get an appointment faster than if someone unknown walks in off the street. No matter which package you choose, our colleagues will arrange the notary appointment for you.

It is up to you whether you decide to be present at the notarisation or whether you prefer to sign the documents abroad. The decision has no influence on our fee.

After the notary appointment, you must open a new business account for your GmbH or UG in formation. We support you competently and quickly in opening an account with our partner banks.

After paying in the share capital, there is a period of waiting for the entry in the commercial register. During this time you are not yet allowed to start any business activity with the company. If you would rather get started immediately after the notary appointment, you can also purchase a shelf company.

Once all registrations have been made, it is possibly to apply for your company's tax number, EU VAT number and EORI number.

* The times are based on experience, which varies from city to city and from foundation to foundation. We recommend that you calculate about 1-3 months for the entire process.

Need a faster solution? Check our imadietely available shelf companies here.

+1 point for GmbH-UG.com: we donate 1% of our profits to charity every year.

| UG | GmbH | |

|---|---|---|

| Formulate the business scope | ||

| Verification of the chosen company name and business purpose with the responsible Chamber of Industry and Commerce (IHK) | ||

| Exchanged Check of the company’s name | ||

| Compliance Check (KYC) | ||

| Organizing a notary appointment in your wished German city | ||

| Founders can sign at different locations | ||

| Legalization abroad is possible | ||

| Online tracking for the company formation process | ||

| Bilingual Certificate of Incorporation (German and English) | ||

| Assistant to save formation costs | ||

| Shareholders can also be foreign companies | ||

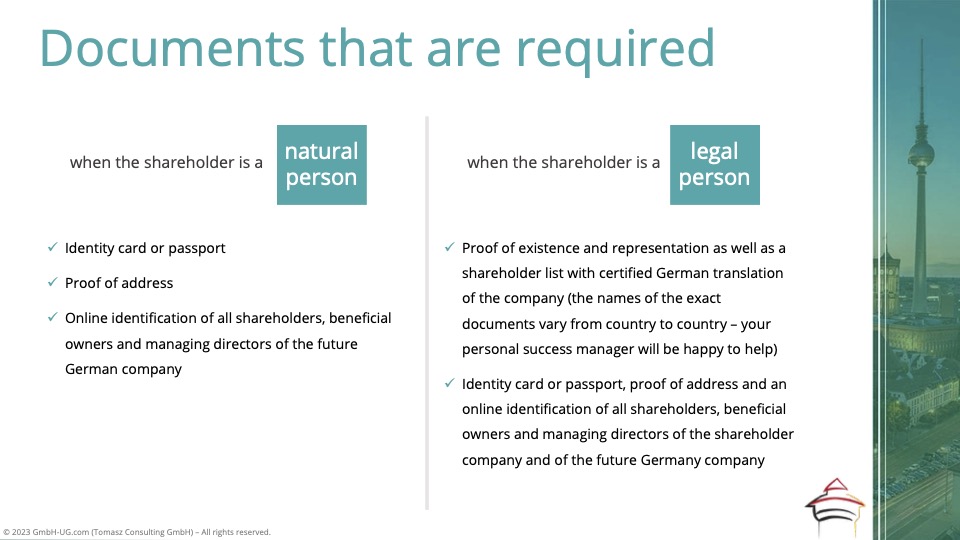

| Checklist of documents required from the foreign shareholder company | ||

| Organizing an interpreter in 25 languages for the notary appointment (Germany-wide) | ||

| Support with opening a business bank account | ||

| 24-hour notification upon entry in the Commercial Register | ||

| Support with the entry in the Transparency Register | ||

| Coordination of business registration (Gewerbeanmeldung) | ||

| Online tool for generate the opening balance | ||

| Application for tax number and VAT number (via German tax advisor) | ||

| Application for EORI number (optional) | ||

| Premium Business Support | ||

| Telephone support (moday-friday 8 AM to 5 PM) | ||

| Direct contact person / Personal Success Manager | ||

| Virtual Office in 6 German cities | from 200 EUR monthly | from 200 EUR monthly |

|

1,800 EUR

(+19% VAT) |

2,200 EUR

(+19% VAT) |